Capital assets are the backbone of both personal and business finance, playing a crucial role in generating income and profit. These assets encompass a wide range of tangible and intangible properties, from land and buildings to intellectual property and investment portfolios. In this guide, we will delve into the definition, types, acquisition, accounting, taxation, management, and examples of capital assets to provide a comprehensive understanding of their importance.

- How to Profit with a Bear Call Spread: A Comprehensive Guide to This Bearish Options Strategy

- Understanding Anticipatory Breach: How to Identify and Address Contract Repudiation in Business

- Understanding Book Runners: The Key Players in IPOs, Leveraged Buyouts, and Securities Issuance

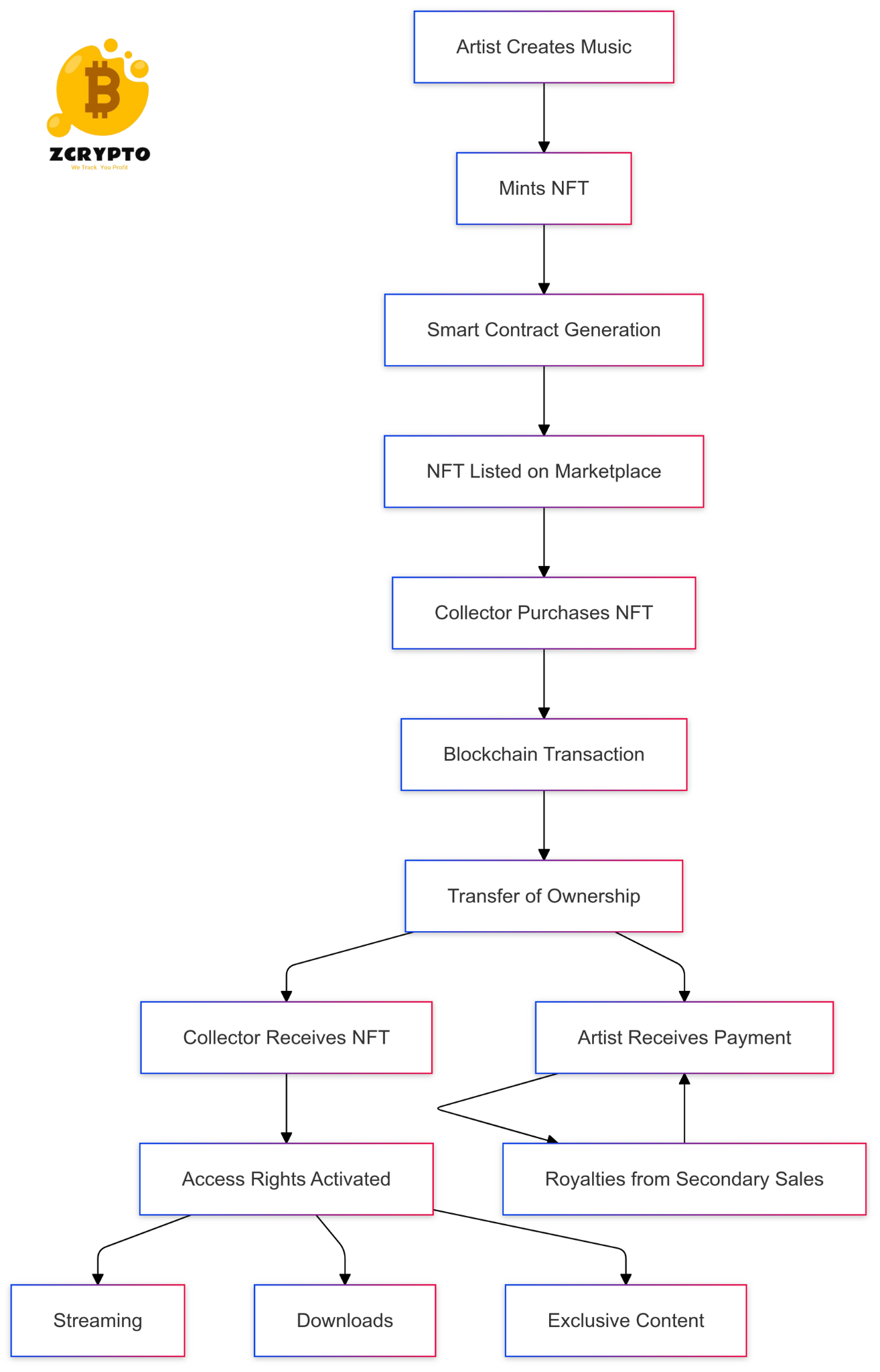

- What is Music NFT? Transforming Artist-Fan Relationships

- How Asset Swaps Work: A Comprehensive Guide to Managing Risk and Optimizing Returns

What are Capital Assets?

Capital assets are defined as any kind of property that is used for generating income or profit. This broad definition includes movable, immovable, tangible, intangible, fixed, or circulating assets. Here are some examples:

Bạn đang xem: Understanding Capital Assets: A Comprehensive Guide to Investments and Business Assets

-

Land and buildings are common capital assets in real estate investments.

-

Equipment, vehicles, and technology are essential for business operations.

-

Intellectual property such as patents, trademarks, and copyrights can be highly valuable.

-

Personal assets like real estate, investment portfolios, and collectibles also fall under this category.

Understanding these assets is crucial for making informed financial decisions.

Types of Capital Assets

Tangible Assets

Tangible assets are physical in nature and can be seen or touched. They include:

-

Property: Land, buildings, and other real estate holdings.

-

Equipment: Machinery, vehicles, and technology used in business operations.

-

Technology: Computers, software systems, and other technological infrastructure.

These assets are recorded on the balance sheet at their original cost and are subject to depreciation over their useful life.

Intangible Assets

Intangible assets are non-physical but still valuable properties. They include:

-

Patents: Exclusive rights granted for inventions.

-

Xem thêm : Establishing a Baseline: Your Foundation for Smart Investments and Financial Growth

Copyrights: Rights to reproduce literary or artistic works.

-

Trademarks: Symbols or names that distinguish products or services.

-

Software: Custom-developed software solutions.

Intangible assets play a significant role in generating revenue but require careful accounting treatment due to their non-physical nature.

Acquisition and Capitalization of Capital Assets

Capital assets can be acquired through various methods:

-

Purchase: Buying assets directly from vendors.

-

Construction: Building assets from scratch.

-

Manufacture: Producing assets internally.

-

Lease-purchase: Acquiring assets through lease agreements with an option to buy.

-

Donation: Receiving assets as gifts.

For an asset to be capitalized, it must meet certain criteria:

-

It must have a useful life greater than one year.

-

It must exceed a certain threshold value set by the company.

Accounting and Depreciation of Capital Assets

Capital assets are recorded on the balance sheet at their original cost. Over time, these assets lose value due to wear and tear or obsolescence, which is accounted for through depreciation.

Recording on Balance Sheet

Capital assets are initially recorded at their purchase price or construction cost. This value is then reduced over time through depreciation.

Depreciation Methods

Xem thêm : What is Mining Pool? A Technical Analysis of Collaborative Cryptocurrency Mining

Common depreciation methods include:

-

Straight-line method: Depreciating an asset by an equal amount each year over its useful life.

-

Accelerated depreciation methods: Such as double declining balance method, where more depreciation is recorded in earlier years.

Amortization of Intangible Assets

Intangible assets are amortized over their useful life rather than depreciated. This process involves spreading the cost of these assets over several years to reflect their diminishing value.

Taxation of Capital Assets

The taxation of capital assets varies significantly from other types of income. Here are some key points:

Tax Treatment

Gains from capital assets are treated differently under tax laws. For example, in the United States, long-term capital gains (gains from assets held for more than one year) are generally taxed at lower rates compared to ordinary income.

Exclusions

Certain assets are excluded from being considered capital assets for tax purposes:

-

Inventory

-

Depreciable property used in a business

Understanding these exclusions is crucial for accurate tax planning.

Management and Stewardship of Capital Assets

Effective management of capital assets is vital for both businesses and public sectors.

Business Operations

Capital assets support business operations by generating revenue and facilitating production processes. Regular maintenance and updates ensure these assets remain efficient and productive.

Public Sector

Government managers have a stewardship duty to maintain public capital or infrastructure assets such as roads, bridges, and public buildings. This ensures these assets remain functional over their lifespan.

Examples and Case Studies

Business Examples

A manufacturing company might use machinery as its primary capital asset to produce goods. A software company might rely heavily on computers and custom-developed software solutions.

Personal Examples

An individual might invest in real estate or collectibles as personal capital assets. These investments can contribute significantly to personal financial net worth over time.

Nguồn: https://horizontalline.icu

Danh mục: Blog