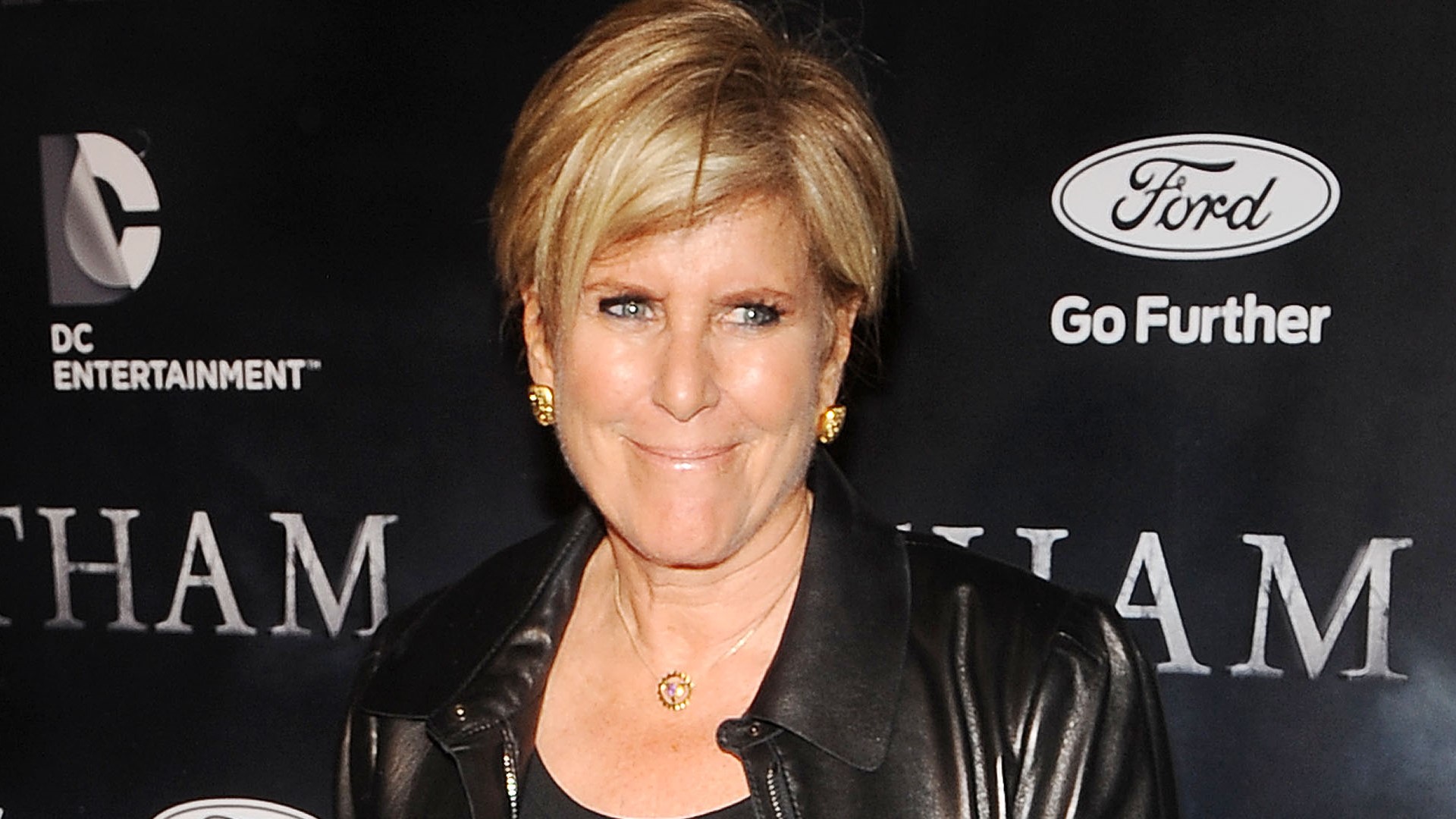

SplashNews.com / Shutterstock.com

Commitment to Our Readers

GOBankingRates’ editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services – our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Bạn đang xem: Suze Orman: 3 Things To Do To Start Retirement Planning in 2025

Trusted by

Millions of Readers

Retirement planning is put off by many for a reason: It’s tough. Not only is it a huge financial responsibility, but it also presents yet another thing to do, when goodness knows we’ve all already got plenty of stuff going on in our lives.

retirement Planner: 7 Ways I Am Guiding Clients Now That Trump Won

retirement Savings

But the reality is: Millions of folks are terribly under-prepared for retirement. And if you’ve yet to embark on retirement planning, you’re one of them — and it doesn’t matter whether you’re 25 or 55. You’ve got to get on top of this.

Financial guru Suze Orman is well-versed in all things retirement, and, in a recent blog post on her site, shared three things to do to kick off your retirement planning.

Start Immediately by Picking Your Plan (of Attack)

We’ve already talked about how important it is to start retirement planning ASAP — and Orman highlighted the urgency.

Xem thêm : Inheritances can strain sibling relationships—how to make estate planning smoother

“If you aren’t yet saving for retirement, yesterday was the best time to start,” she wrote.

But how do you start immediately? What are your options? Orman broke those down.

“If your employer offers a retirement plan and also kicks in a matching contribution, that is the place to start. Never turn down a matching contribution,” Orman wrote. “And if your plan offers a Roth 401(k), I would consider using that for future contributions rather than the Traditional 401(k). Both are great ways to save for retirement.”

The primary difference between a Roth 401(k) and a traditional 401(k) is when your taxes are due on the funds.

“With a Roth 401(k) you contribute money that has already been taxed,” Orman explained. “Then it can grow for decades tax-exempt, and when you make withdrawals in retirement you get the big win: no tax is due on your withdrawal.”

With Traditional IRAs, your contribution is made with pretax dollars. And you will have to pay taxes on it eventually.

“It too grows tax-exempt for decades, but in retirement when you make withdrawals every penny will be taxed at your ordinary income tax rate,” Orman wrote.

If you’re self-employed or your workplace does not offer a retirement plan (shame on them!), you still have options and should investigate them pronto.

“You can open an Individual Retirement Account (IRA) at any brokerage, such as Fidelity, Schwab or Vanguard,” Orman wrote. “You will have two options for the type of IRA: Roth or Traditional. My strong preference is the Roth IRA. The IRA contribution limit this year is $7,000 if you are younger than 50, and $8,000 if you are older.”

Aim To Save 15% of Your Income for Retirement

We know you must be tired about hearing about how you need to save money, but frankly, financial experts are only repeatedly telling you to do this because it’s so very important. If you want a comfortable retirement, you need to be aggressively saving — even if you’re a big earner.

“As a general rule, I want you to aim to save 15% of your income for retirement,” Orman said. “If you can’t commit to that right now, start with 5% or 6% or 10%. And then promise yourself you will increase that rate by at least 1 percentage point every six months, or year.”

Get Thinking About How You Can Delay Getting Social Security

Those relying on Social Security as their primary source of income in retirement are, by and large, having a tough time getting by in comfort. To maximize the amount you will receive every month from Social Security, you should claim later then when you’re eligible.

“You are allowed to start at 62, but every month you wait earns you a higher benefit,” Orman said. “The benefit at your full retirement age (between 66 and 67, depending on the year you were born) will be 25% to 30% higher than your age 62 benefit.”

Orman recommends beginning to collect Social Security benefits at the age of 70.

“If you expect to live well into your 80s and 90s, delaying pays off big time,” she said.

Nguồn: https://horizontalline.icu

Danh mục: News