- Court Denies James Howells’ Bid for $770 Million Bitcoin Hard Drive (10/01/2025)

- Financial Advice Host Ric Edelman Wraps Three Decades In Front Of The Mic. | Story

- Retirement Planning: Have financial ‘Plan B’ ready to take care of unforeseen risks

- Small business financial planning for 2025 | Coffee-break

- Merit Financial Acquiring $739 Million Firm Zimmermann Investment

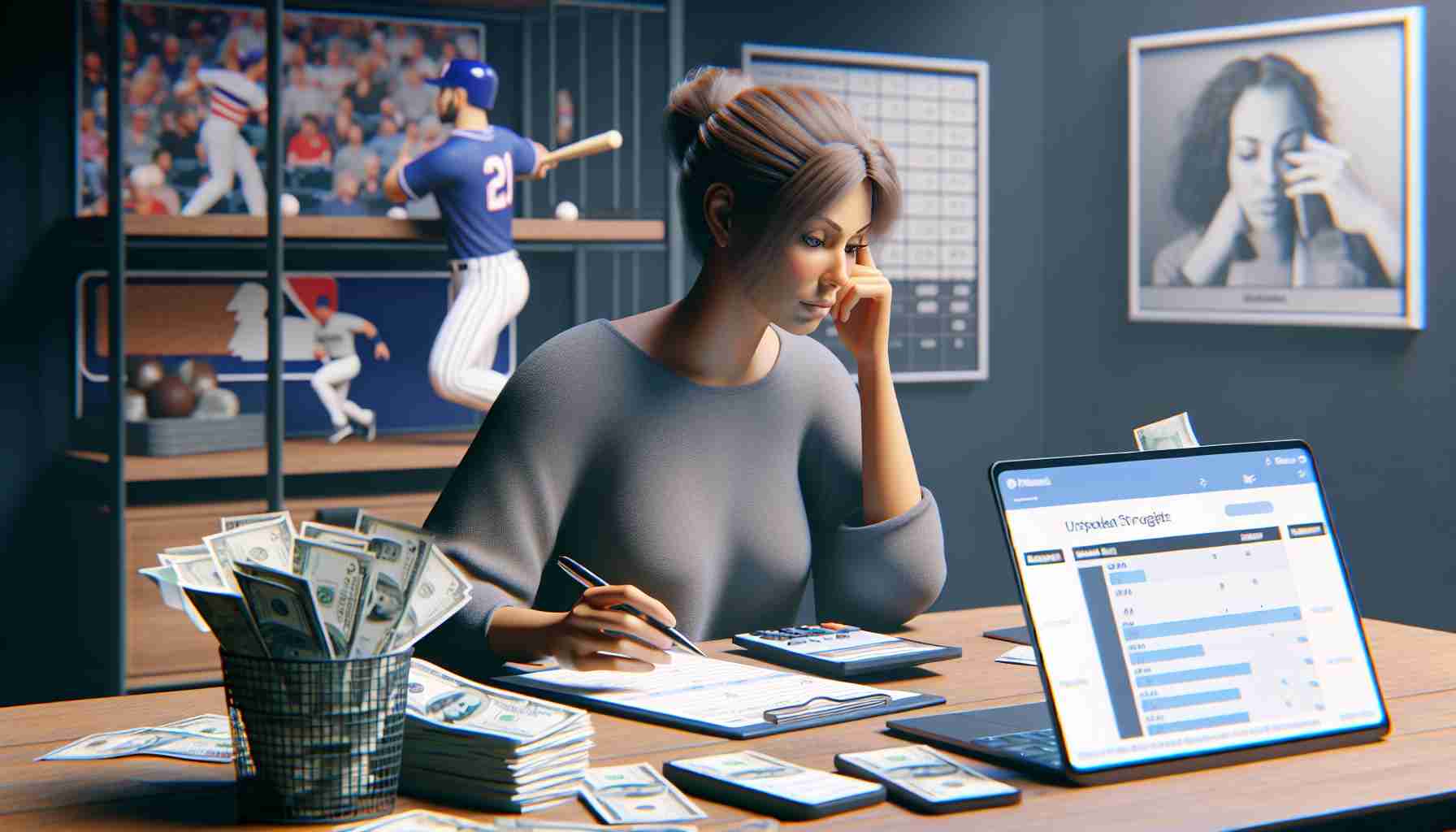

In a recent update on her YouTube channel, Tomomi Itano opened up about the unique financial concerns that come with being married to a professional athlete. The former AKB48 star, now married to Tokyo Yakult Swallows pitcher Keiji Takahashi, shared insights about the tax implications that can arise for players, especially after retirement.

Bạn đang xem: Challenges of Being a Baseball Player’s Wife! The Unspoken Financial Struggles

In an engaging discussion with former pro baseball player and current commentator Yoshinori Satoh, Itano inquired about the income dynamics following a player’s retirement. Satoh clarified that players receive one final paycheck in December, but if they do not remain with the team, they can find themselves without income starting in January, all while still facing tax obligations.

Itano expressed her personal realization regarding these financial pressures. She reflected on how her husband, who had a successful stint in the World Baseball Classic two years ago, faced a significant tax burden last year due to a salary reduction. Itano noted that the taxes were shockingly high, particularly when compared to their earnings, highlighting how unexpected financial challenges emerge in the athletic world.

Through her candid remarks, Itano shed light on the lesser-known aspects of an athlete’s financial journey, illustrating that the glamour of professional sports can often obscure the reality of economic uncertainty.

Understanding the Financial Realities of Marrying a Professional Athlete

Introduction

Marrying a professional athlete often comes with a unique set of financial concerns that are not immediately apparent. Tomomi Itano, a former member of the popular Japanese idol group AKB48 and now married to Tokyo Yakult Swallows pitcher Keiji Takahashi, recently highlighted these challenges in a candid discussion on her YouTube channel. Her insights bring to light the complexity of financial management faced by athletes and their families.

Financial Dynamics Post-Retirement

Xem thêm : 6 Key Signs for Millennials That Your Retirement Is On Track

One significant issue that Itano discussed is the financial implications after a player retires. According to former professional baseball player Yoshinori Satoh, athletes typically receive a final paycheck in December. However, if they are not signed by a new team by January, they could experience a sudden income void, all while still being obligated to pay taxes on their previous earnings.

# How Do Athletes Manage Their Finances?

1. Post-Career Planning: It’s essential for athletes to plan their financial future well before retirement. This includes seeking financial advisors who specialize in post-career management.

2. Tax Consultation: Understanding one’s tax obligations is crucial, particularly in the higher tax brackets many athletes fall into. Regular consultations with tax professionals can help manage this aspect effectively.

3. Investment Strategies: Diversifying income sources through investments can provide financial stability. This might include stock investments, real estate, or starting a business.

The Reality of High Taxes

Itano shared personal experiences regarding the immense tax burdens athletes often face. After her husband’s participation in the World Baseball Classic, he encountered a noticeable salary reduction, which, combined with high tax rates, made financial planning even more complicated. The disparity between actual earnings and tax obligations can create financial strain, leading to wider discussions about the economic realities athletes face.

Pros and Cons of Marrying an Athlete

Xem thêm : Farther Welcomes Financial Advisor Mark Manetti, Managing $200 Million in Assets

# Pros:

– Lifestyle Opportunities: Access to unique experiences and a lavish lifestyle.

– Networking: Connections with other athletes and influential figures.

– Support System: Emotional and logistical support during their partner’s career.

# Cons:

– Financial Instability: Fluctuating incomes and unexpected financial responsibilities can pose challenges.

– Public Scrutiny: The personal lives of athletes and their families often receive media attention, leading to privacy concerns.

– Career Uncertainty: The unpredictable nature of sports careers can complicate future planning.

Use Cases for Financial Education

Athletes’ spouses should prioritize understanding financial literacy to better manage their family’s finances. Practical workshops and resources can empower them to make informed decisions regarding investments, spending, and tax management.

Trends and Insights

The financial realities of professional sports have raised awareness about the importance of financial education. Numerous athletes are now advocating for better financial literacy programs, which can significantly affect their post-career lives and those of their families.

Conclusion

Tomomi Itano’s discussion on the complexities surrounding finances in the world of professional athletics underlines an often overlooked area of concern. As more athletes share their experiences, it becomes clear that financial planning and management are crucial for ensuring long-term stability. Those involved in professional sports must be prepared not just for the glamour but also for the unpredictable financial landscape that comes with it.

For more insights on managing finances in sports, visit ESPN.

Nguồn: https://horizontalline.icu

Danh mục: News