What Is a Bank Statement?

A bank statement is an official document that summarizes the activities in your checking or savings account over a specific period, usually monthly. It includes all transactions such as deposits, withdrawals, and fees incurred during that period. Bank statements cover various types of accounts including checking accounts, savings accounts, and even credit card accounts.

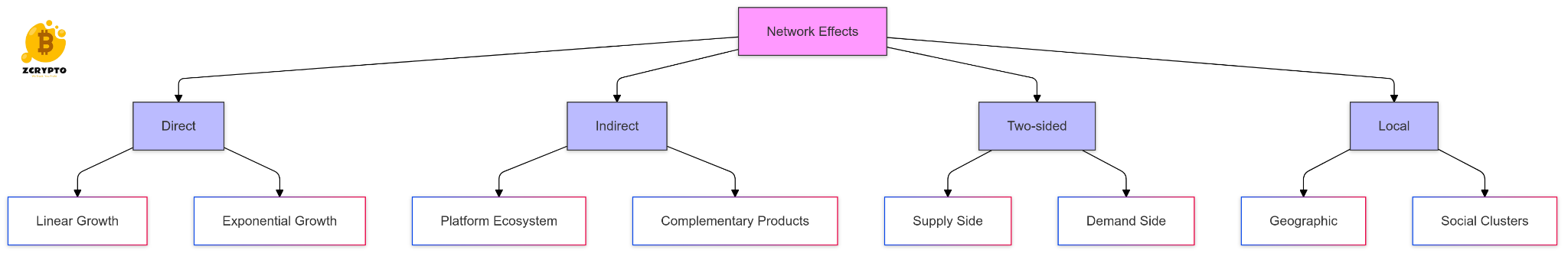

- What is Network Effect? Analyzing Value Growth in Connected Systems

- Navigating the Business Cycle: A Guide to Investment Strategies and Economic Phases

- Unlocking Investment Opportunities: A Comprehensive Guide to the Amsterdam Stock Exchange (AEX)

- How Cash Dividends Work: A Guide to Earning Income from Your Investments

- 341 Meeting: A Comprehensive Guide on What It Is, How It Works, and Real-World Examples

How to Obtain a Bank Statement

You can obtain your bank statement through various methods. Most banks offer electronic statements via online banking platforms, which can be viewed or downloaded anytime. Alternatively, you can receive paper statements mailed to your address or request a printed statement at your bank branch.

Bạn đang xem: How to Read and Understand Your Bank Statement: A Step-by-Step Guide[2][3][5]

Key Components of a Bank Statement

Statement Period

The statement period indicates the time frame covered by the statement, usually listed near the top as ‘Statement Ending’ followed by a date or a range of dates. This helps you understand which transactions are included in the current statement.

Bank and Personal Information

Ensure the bank’s logo and your personal information, such as name, address, and phone number, are correct and up-to-date. Incorrect information could indicate fraudulent activity.

Interest Earned Information

For interest-bearing accounts like savings or deposit accounts, the statement includes a summary of the interest earned during the statement period and the total interest earned year-to-date.

Account Activity

-

Xem thêm : What Is Big Data in Cryptocurrency

Deposits: List every ATM or direct deposit, credit, or other activity that deposits money into your account.

-

Withdrawals: Detail every instance money leaves your account, including debit purchases and account withdrawals.

-

Fees: Include monthly service fees, insufficient funds fees, and other charges.

How to Read and Understand Your Bank Statement

Step-by-Step Guide

-

Check the Statement Period: Ensure it matches your records.

-

Verify Personal and Bank Information: Confirm that all details are accurate.

-

Review Transactional Data: Go through each transaction entry noting dates, descriptions, and amounts.

-

Xem thêm : Databricks nears 9.5 billion mega-investment

Reconcile the Closing Balance: Compare it with your internal records to ensure accuracy.

By following these steps systematically, you can ensure that all recorded activities are accurate and up-to-date.

Importance of Regularly Checking Your Bank Statement

Regularly reviewing your bank statement helps track spending patterns, identify unusual or fraudulent transactions, and ensure all recorded activities are accurate. This practice aids in managing budgets effectively and spotting trends in spending or saving. It also helps detect errors or unauthorized transactions early on.

Practical Applications of Bank Statements

Budgeting and Financial Planning

Bank statements provide detailed records of your financial activities which are essential for effective budgeting and financial forecasting. They help you track income and expenses accurately, identify trends in spending or saving habits, and make informed decisions about future financial plans.

Tax Preparation and Loan Applications

Bank statements are valuable during tax season as they provide a record of all financial transactions helping to verify income and expenses. They are also required when applying for loans to demonstrate financial stability.

Fraud Detection

Regularly reviewing your bank statement helps detect unauthorized transactions or suspicious activity ensuring that your financial assets are safeguarded against fraud.

Nguồn: https://horizontalline.icu

Danh mục: Blog